The UK government boosts its citizens’ donations to UK-based charities by 25p for every £1 given. KLC reclaims this Gift Aid from the tax the donor pays for the current tax year. This means that KLC benefits and it costs the donor nothing (except in the case of point 3 below).

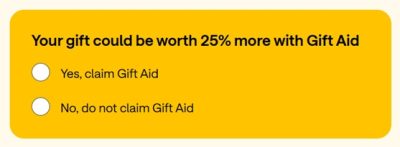

KLC endeavours to make it easy for donors to Gift Aid their donations. Stewardship is our preferred platform and includes an easy opt-in button when making your donation.

If you are a UK citizen donating via one of our Stripe donation forms, please use the drop-down options to say “Yes! Gift Aid my donation!” and to indicate that you have read the terms described here. Thank you!

1. Your address is needed to identify you as a current UK taxpayer. If you are donating via Stripe, KLC uses your given billing address for this purpose.

2. If you are making a recurring donation, your Gift Aid declaration covers any future donations to KLC too.

3. Note that your declaration includes the following acknowledgement:

“I am a UK taxpayer and understand that if I pay less Income Tax and/or Capital Gains Tax than the amount of Gift Aid claimed on all my donations in that tax year it is my responsibility to pay any difference.”

4. If you pay Income Tax at the higher or additional rate and want to receive the additional tax relief due to you, you must include all your Gift Aid donations on your Self-Assessment tax return or ask HM Revenue and Customs to adjust your tax code.

5. If you participate in a donation campaign that offers you a gift from KLC in return, note that we only claim from Gift Aid the net donation amount (i.e., we deduct the costs of our gift to you).

6. Please notify KLC if you: